Real Estate

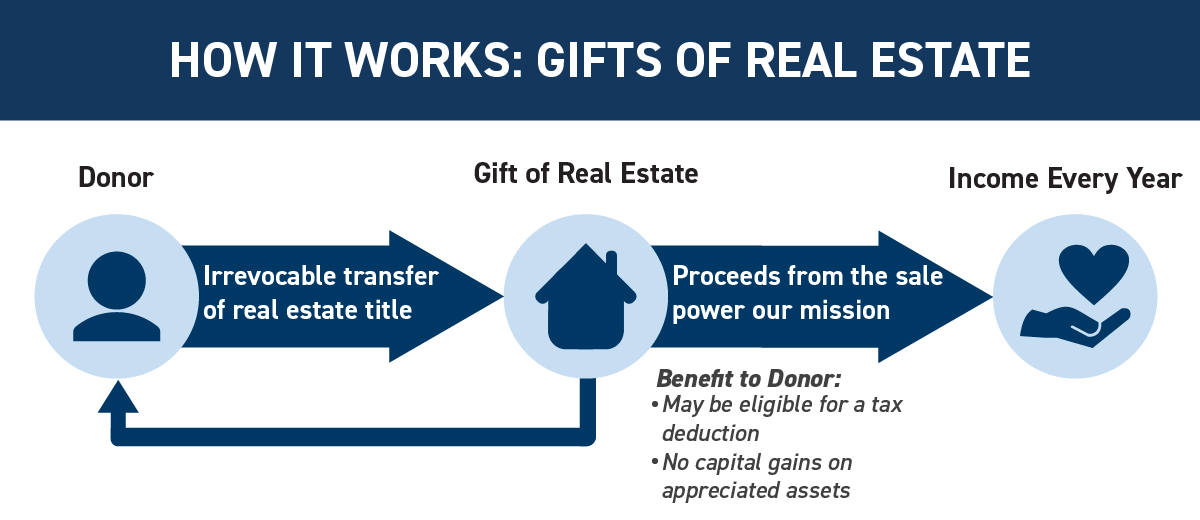

Making a gift of your real estate can have a substantial impact on Rye Presbyterian Church and provide you with some great benefits.

An outright gift of real estate to Rye Presbyterian Church can have a dramatic impact on our mission for many years into the future. If the property has appreciated in value and you have held the property for more than 12 months, you may be eligible for a federal income tax deduction, may avoid the capital gains tax on the appreciation, and will remove the property from your taxable estate. Plus you no longer have the burden of property maintenance, property tax, insurance and other aspects of property ownership.

Aside from giving the property "outright" today, there are other ways you might consider making a gift of property:

- Retained Life Estate: You can deed your real estate to Rye Presbyterian Church, receive current tax benefits and still make full personal use of your real estate for the rest of your life. Under this arrangement, you continue responsibility for all maintenance, insurance and taxes until possession transfers to Rye Presbyterian Church after your lifetime. Your current tax deduction is based on the fair market value of your home minus the present value of the life tenancy you have retained.

- Charitable Remainder Trust: Your real estate can fund a charitable unitrust that will pay you an income for life.

- Testamentary: Through your will or trust, you may direct the transfer of your property to Rye Presbyterian Church. As a testamentary gift, the real estate transfer and any resulting tax benefit occurs after your lifetime; there is no current tax benefit, although some may be realized later. In case your family's circumstances change, you can change your will or trust and direct the real estate where it is needed.

Overview of the process

- Please contact us to discuss your generous offer of real estate.

- Check with your professional advisors for guidance on how this fits into your financial and estate plans.

- Assessment: We work with you and your advisors to ensure that the gift is right for both you and Rye Presbyterian Church. Each offer of real estate is assessed for marketability and evaluated for any conditions that may be a liability, risk, or obstacle for Rye Presbyterian Church to own or sell the property.

- Fair Market Value: The IRS requires that you get independent appraisal to provide the fair market value of the property.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Explore More Options