Donor Advised Fund

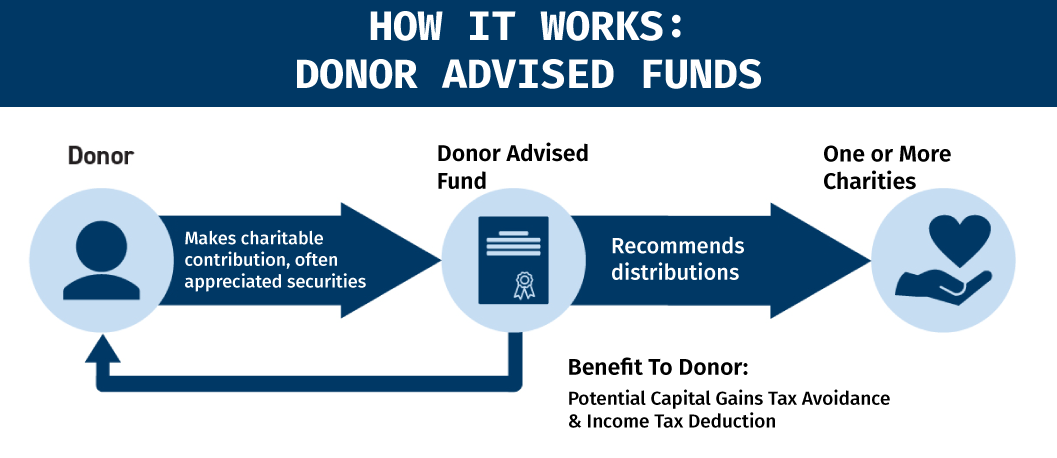

The donor advised fund is like a charitable giving account that can help you give more simply and more efficiently.

When you donate to your donor advised fund, your contribution is eligible for a tax deduction, just like any IRS-qualified charitable organization. From the accumulated balance in your charitable fund, you can make grant recommendations to almost any public charitable organization. You can recommend how much to send and when. You might even schedule recurring gifts or a major gift on a future date.

What are the benefits?

- Simplicity: Manage all of your charitable giving in one simple place. One single larger gift can be divided into all of your gifts.

- Tax-Smart: Many givers avoid tax-efficient gifts, because many charities struggle to receive them. Instead, you can apply tax efficient to all of your gifts by making just one single tax-efficient gift to your donor advised fund.

- Tax-Reporting: You have fewer gift receipts to keep track of.

- Less Work to Send Funds: You simply recommend qualified beneficiaries, and the fund sends the contributions for you.

- Record Keeping: Your contributions and charitable distribution history are easily accessible.

How Does It Work?

- First, choose a fund sponsor or provider and establish your donor advised fund.

- Choose your fund advisor(s) who makes recommendations where and when to make charitable distributions.

- Make an irrevocable contribution to the fund, usually cash or appreciated securities. Your gift is eligible for an immediate tax deduction and may avoid capital gains. Future contributions can be added at any time.

- Charitable Gifts: You can make recommendations at any time now or in the future, or even set up recurring gifts. Your chosen recipients must be a qualified public charity, which will be verified by your fund's sponsoring organization.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Explore More Options