Pooled Income Fund

A simple tool and great benefits for Rye Presbyterian Church and you.

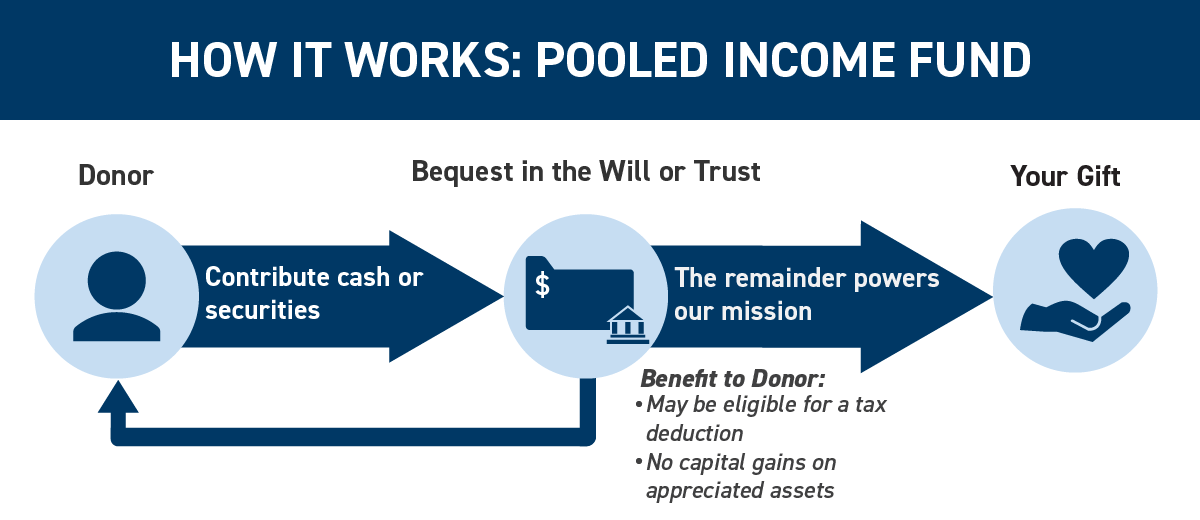

Your gift of cash or securities purchases shares of a charitable trust, into which other donors also contribute, much like a mutual fund. You, or persons you name, receive a proportional share of the trust's net income for life. After the income beneficiary's lifetime, the shares you gifted to the fund are withdrawn and contributed to Rye Presbyterian Church's mission.

Income varies quarterly with the trust's investment performance.

Benefits to You

- Receive variable income for life, for yourself and for others

- Simplicity through participating in an existing trust

- Potential immediate tax deduction

- No capital gains on the transfer of appreciated assets

Generosity: You are providing meaningful support to Rye Presbyterian Church: the residual value of your pooled income fund shares is distributed as valuable support for Rye Presbyterian Church after your lifetime.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Explore More Options