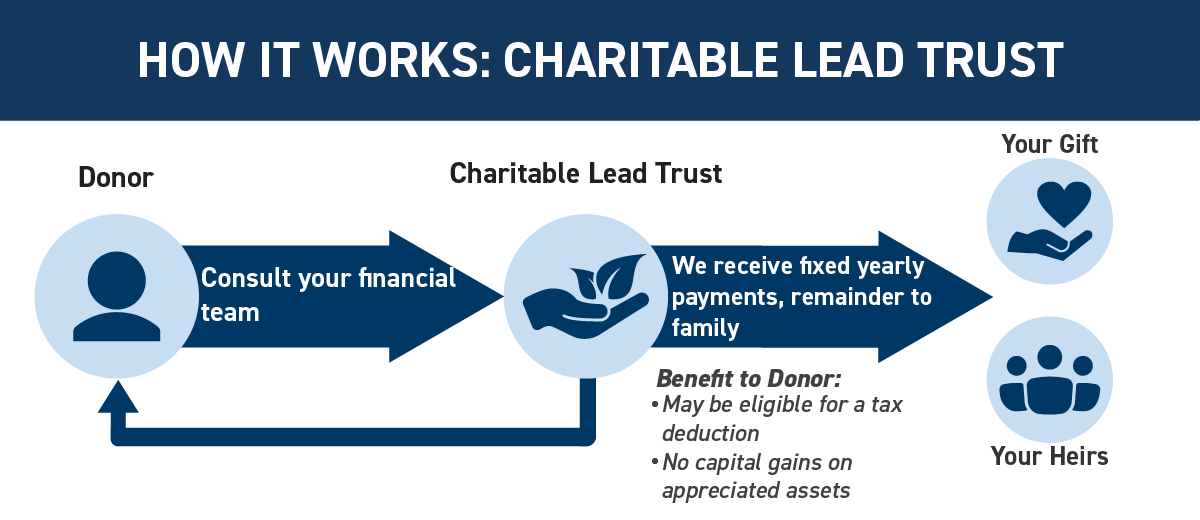

Charitable Lead Trust

Establish and fund a trust to provide a substantial recurring annual income to Rye Presbyterian Church for a set period of years - and then return the trust assets to your family in the future with little or no tax liability.

Your Charitable Lead Trust (CLT) pays Rye Presbyterian Church an interest income annually for a pre-set number of years or for your lifetime, after which the assets return to the beneficiaries that you name.

By transferring assets to a CLT it may be effectively removed from your estate and passed to your heirs with little or no tax liability. A gift tax discount arises because of the charitable interest preceding your heir's interest.

There are two types of lead trusts:

- A CLT unitrust pays a fixed amount to Rye Presbyterian Church

- A CLT annuity trust pays a fixed percentage of the trust's value determined annually to Rye Presbyterian Church.

If you structure your CLT to return assets to you (not your heirs), you may obtain an income tax deduction for the charitable interest.

Benefits

- Significant multi-year support for Rye Presbyterian Church

- Pass the CLT assets to heirs at a future date

- Maximizes value to heirs by removing the CLT assets from estate tax exposure

- Further maximizes value to heirs by potentially removing the CLT assets from exposure to gift taxes

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Explore More Options