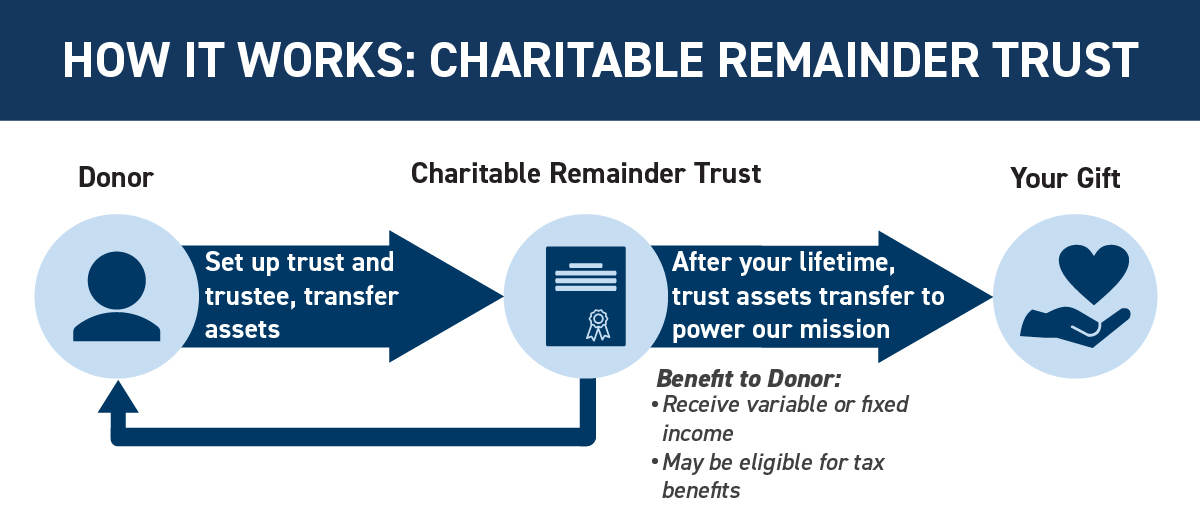

Charitable Remainder Trust

A gift that can provide income and more

A charitable remainder trust begins with an irrevocable gift of assets into a charitable trust that provides you a fixed or variable income for life or for a set term. At the trust's termination, the trust assets become a generous gift to Rye Presbyterian Church.

Types of Charitable Remainder Trusts

- Unitrust: The unitrust's income varies on an annual basis. At the establishment of the trust, a reasonable and permissible income percentage rates is determined. Annually, the trust assets are valued, and the established rate is applied to the annual value in order to determine your income. As the trust assets increase or decrease, your income increases or decreases as well. It may be possible to make additional contributions to the trust.

- Annuity Trust: The income is predictable and fixed. When you establish the trust, you set a reasonable and permissible fixed annual income based on a percentage of at least 5% of the initial market value of the trust's assets. Even as the value of the trust fluctuates, your income remains the same - except in the very unlikely and uncommon event that the trust assets are exhausted. Additional contributions to the trust are not permitted.

Benefits for you

- Income: Payments are distributed for life or a fixed period to you or to whomever you designate.

- Tax Deductions: You may be eligible for a tax deduction the year the trust is established.

- Capital Gains: You may avoid up front capital gains tax.

- Estate Tax: Trust assets are not a part of your estate.

Video Guide

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Explore More Options