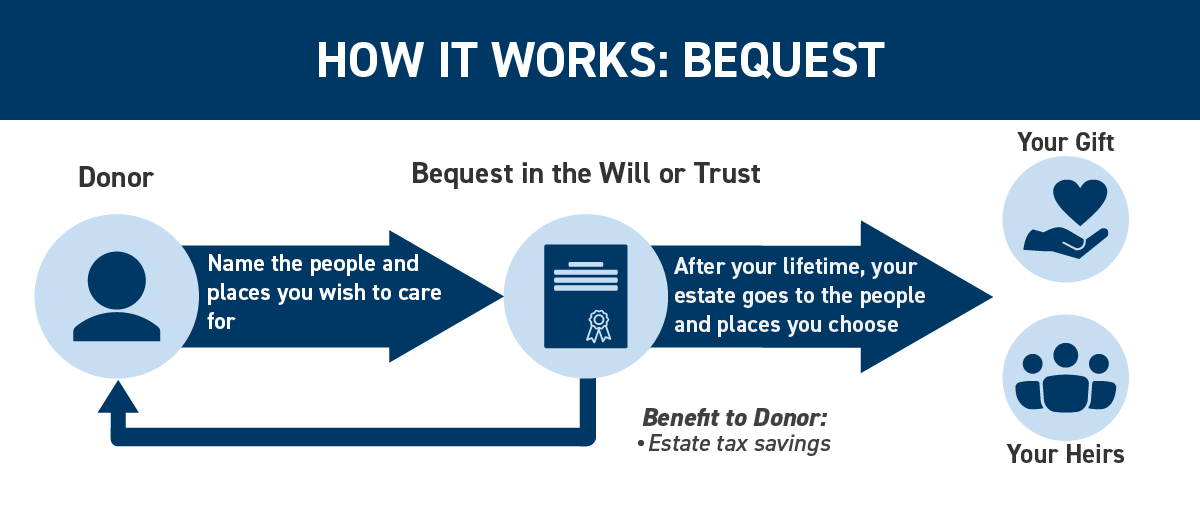

Charitable Bequests

A will represents a person's final wishes and intentions. After providing for your loved ones, please consider one final act of generosity through a bequest in your will or living trust that provides enduring support for our vital work. For many of us, this will be the most significant gift we will make - our gift of a lifetime.

Tools to Make a Bequest

If you have not done so, you need to make a will or a living trust instrument. This is a significant and important undertaking. If you have a will or living trust, you may see your attorney to make an amendment.

Types of Bequests

- Specific Bequest: You may leave a specific asset or assets, such as real estate, securities or a specific dollar amount. Click for sample bequest language.

- Percentage Bequest: You may leave a specific percentage of your overall estate to Shepherd of the Hills. Click for sample bequest language.

- Residuary Bequest: You may gift the remaining balance of the estate after all specified distributions are made and all obligations have been satisfied. Click for sample bequest language.

- Contingent Bequest: A contingent bequest is one that takes effect only if the primary beneficiary or beneficiaries of the bequest are unable to accept the bequest. Usually this means that the primary beneficiary does not survive the benefactor or else disclaims the property. By naming Shepherd of the Hills as contingent beneficiary, we would receive your generous bequest only if the purpose of the primary bequest cannot be met. Click for sample bequest language.

Bequest Video Guide

Next Steps

Contact us to talk more specifically about options and benefits.

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Explore More Options