Planned Giving

Gift of Life Insurance

A most generous gift

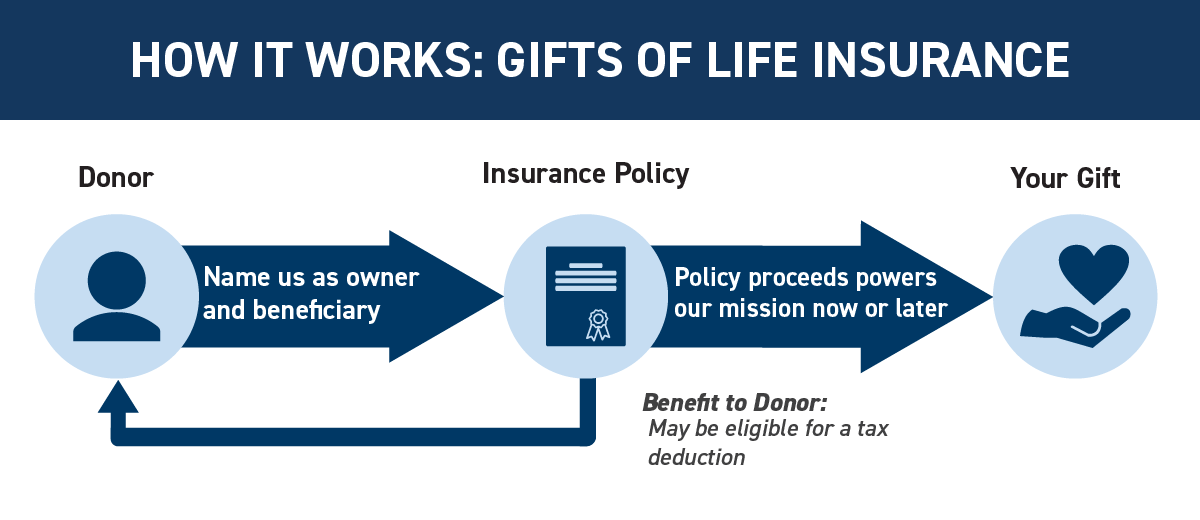

Life insurance's primary goal is to protect our loved ones. In situations where life insurance has served its original purpose, it can be a wonderful and significant gift to Westchester Parks Foundation.

Steps to Gift Insurance

- Request a designation form from your insurer.

- Name Westchester Parks Foundation as owner and beneficiary of your paid-up life insurance policy (see table below for other strategies). When making Westchester Parks Foundation owner and/or beneficiary of an insurance policy, please contact us to ensure your request is honored.

- You are eligible for a tax deduction for the cash value of the policy.

- Your generous gift of an existing insurance policy may be kept for future benefit or cashed in by Westchester Parks Foundation.

Here are some other ways to make a gift of life insurance.

| Gift Option | Tax Benefits |

|---|---|

| Donate a paid-up policy | Deduct the approximate cash-surrender value |

| Purchase a new life insurance policy | Deduct the premiums if Westchester Parks Foundation is named the owner |

| Donate a policy where you continue to pay premiums | Deduct the approximate cash value and future premiums |

| Name Westchester Parks Foundation as the beneficiary (primary, secondary or contingent) | No immediate tax benefits available, but the asset is not included in your taxable estate |

Contact Us

Erin Cordiner

Director of Philanthropy and Community Engagement

tel: 914-231-4600

erin@thewpf.org

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Explore More Options