Planned Giving

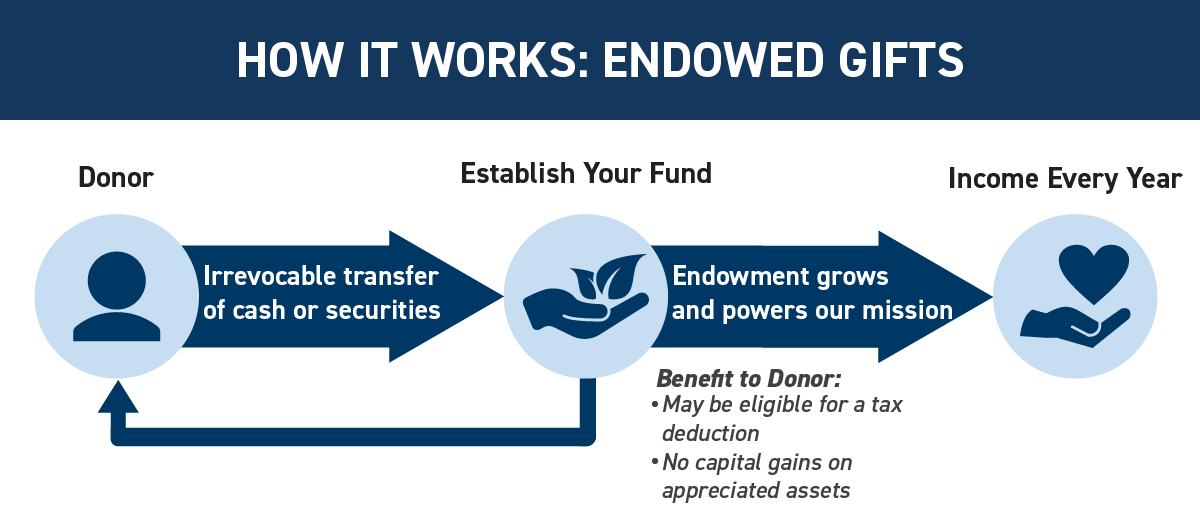

Endowed Gifts

Ensuring Westchester Parks Foundation's mission now, tomorrow and forever

Each of us wants to know the people and places we love will thrive even after our lifetimes. Fortunately, today you can plan your resources to know this will happen — even after you are gone.

Through your endowed gift you can be confident that your work will continue here at Westchester Parks Foundation forever. An endowment is a fund that is invested in perpetuity and distributes an annual income that will prove to be vital to Westchester Parks Foundation's mission.

You have worked hard to earn and save throughout your lifetime. You can be assured that your gift will be used well and be honored for all future generations.

Endow your Annual Gift

Your annual gift is an important part of how we fund our mission. Would you like to consider making your annual gift in perpetuity? Establishing an endowment is a sensible way to ensure this happens. Most endowments generate 4% to distribute annually, so as a general rule of thumb an endowment may be 25 times your annual gift. For many this sum may not be immediately available and so might choose to set up their own endowment through their will or trust. Here are sample amounts for an endowment based on gift size:

| For this size annual gift | You might establish this size endowment |

|---|---|

| $1,000 | $25,000 |

| $2,000 | $50,000 |

| $2,500 | $62,500 |

| $5,000 | $125,000 |

| $10,000 | $250,000 |

| $20,000 | $500,000 |

| $50,000 | $1,125,000 |

Restrictions: You may wish to provide certain "restrictions" or guidance on how the endowment funds are distributed. Generally, Westchester Parks Foundation has many varying needs from year-to-year and generation-to-generation, so unrestricted gifts provide the greatest flexibility to respond to changing needs. However, if you do wish to include restrictions, please communicate your preferences with us prior to setting up the endowment so we can ensure the restrictions are feasible and that we can honor them in perpetuity. If you do prefer a specific restriction, we highly recommend that you include language to enable the governing board flexibility in redistributing the income to a relevant area or the most needed areas. Regardless, if yours is a named fund, we will certainly honor the continued name of the fund.

Benefits

- You will continue to support future generations beyond your lifetime.

- You can name your endowment fund.

- Endowment contributions are deductible - depending on the asset given and method chosen to give.

Contact Us

Erin Cordiner

Director of Philanthropy and Community Engagement

tel: 914-231-4600

erin@thewpf.org

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Explore More Options