Planned Giving

Contact Us

Melanie Sastria

Phone: 530-753-2894x109

E-mail: finance@dccpres.org

Planned Giving

A simple tool and great benefits for Davis Community Church and you.

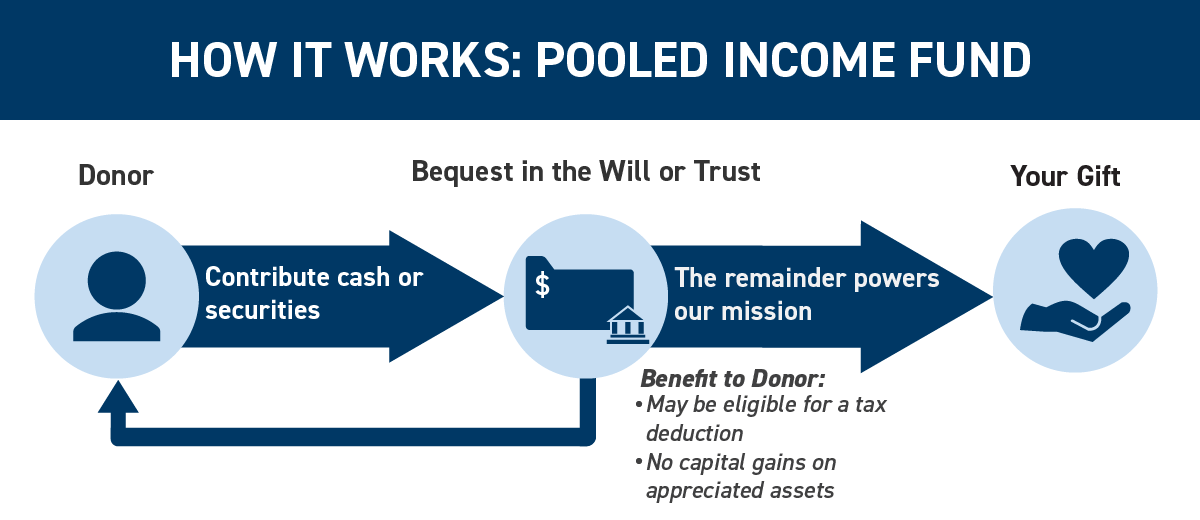

Your gift of cash or securities purchases shares of a charitable trust, into which other donors also contribute, much like a mutual fund. You, or persons you name, receive a proportional share of the trust's net income for life. After the income beneficiary's lifetime, the shares you gifted to the fund are withdrawn and contributed to Davis Community Church's mission.

Income varies quarterly with the trust's investment performance.

Generosity: You are providing meaningful support to Davis Community Church: the residual value of your pooled income fund shares is distributed as valuable support for Davis Community Church after your lifetime.

Melanie Sastria

Phone: 530-753-2894x109

E-mail: finance@dccpres.org

Thank you for considering this gift!

The gift descriptions are for informational purposes and are not legal or tax advice. To ensure that this gift fits your particular circumstances and planning, please consult with your professional advisers.

Explore More Options